Let's starts with the offer packet, which is made up of 3 categories:

1. Monetary

Any money taken directly home. This could include—

A signing bonus, your base salary, or public company equity

2. Near-Monetary

Benefits that prevents money from coming out of your wallet, such as free lunch or commuter benefits

3. Non-Monetary

Anything that doesn’t impact your wallet, but can improve the quality of your work, such as PTO or a learning stipend

Base Salary: the initial salary paid to an employee, not including any benefits, bonuses, or raises.

Annual Bonus: a lump-sum payment (cash, shares, etc.) made once a year in addition to an employee's normal salary or wage for a fiscal or calendar year. This is usually a percentage of the base salary and is dependent on performance standards:

Signing Bonus or Sign on bonus: one time paid to a new employee by a company as an incentive to join that company. This bonus is typically received with the first paycheck or prorated over the first x months of employment.

Public Company Equity - Stock Grants:

A form of compensation issued by an employer to an employee in the form of company shares.

Upon vesting, they are considered income, and a portion of the shares is withheld to pay income taxes. The employee receives the remaining shares and can sell them at their discretion.

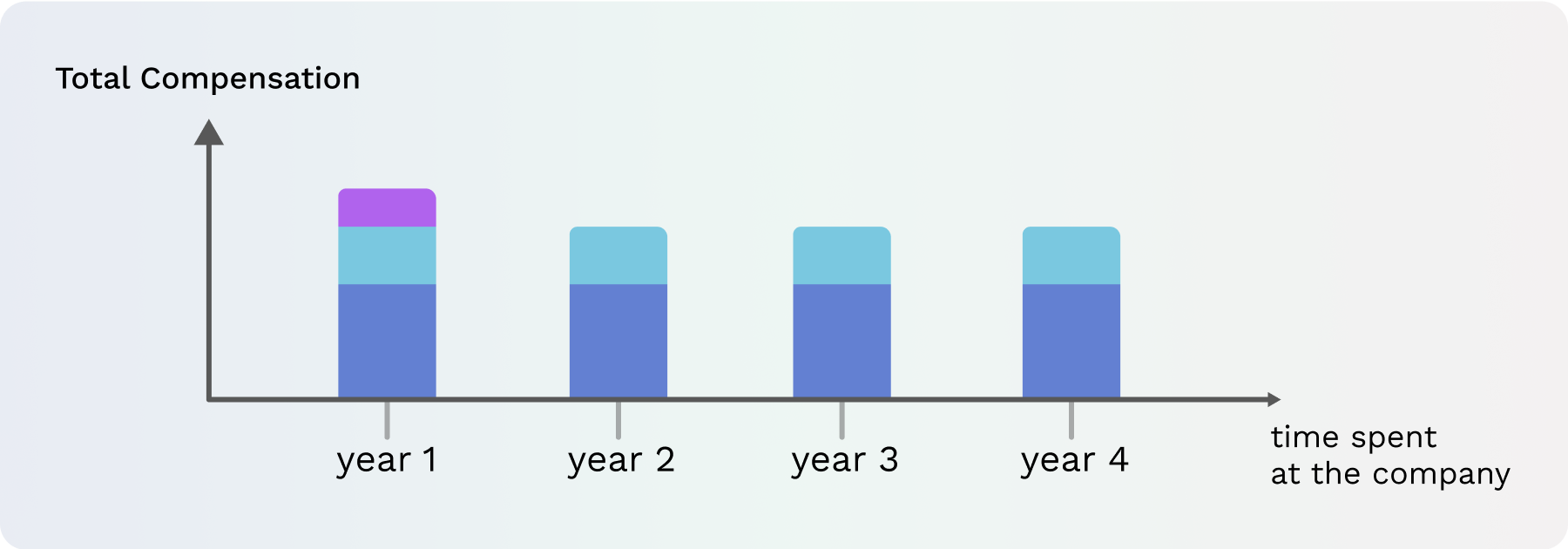

A typical vest schedule spans over 4 years with a 1-year cliff, meaning you can’t vest any shares until 1 year from your start date

After the cliff, a generic vesting schedule is set in place. This may be monthly or quarterly, depending on the company. In the above case, the employee vests 1/4th of their shares after the 1 year cliff. After that, they can vest 1/48th of their shares each month if they’re on a monthly schedule.

Private Company Equity - Stock Grants:

Unlike stock options that are a share of a company, options are the right to buy or sell a set number of company shares at a fixed price, usually called a grant price, strike price, or exercise price.

If the value of the stock goes up, selling at your cheaper strike price unlocks an opportunity to make money on the difference. Unfortunately, real life is not as smooth and profitable as this graph. In a later article, we will go through the steps to understanding options, their risk profile, and how to assess them.

Healthcare / Vision / Dental benefits: select insurance plans offered the employer that an employee can opt into for a select fee per month. This fee may change if dependents (ie. kids) are also relying on the same insurance plans. This amount is typically deducted from the paycheck.

Commuter benefits: typically a monthly stipend offered by employers that reimburses travel to work or work-related events. Typically a fixed amount.

401K match program: your employer contributes a certain amount to your retirement savings plan based on the amount of your own annual contribution. The employer match may be a fixed amount or based on the percentage of the employee's salary. These contributions live in a 401k retirement account.

Employee Stock Purchase Program (ESPP): company-run program in which participating employees can purchase company stock at a discounted price.

Meal reimbursements: stipend offered to cover meal costs. This is typically a recurring reimbursement if it is offered.

Office Equipment reimbursement: stipend offered to cover office equipment. This is typically a one time reimbursement upon joining.

Paid Time Off (PTO) or Vacation Policy: considered to be any time an employee is getting paid while away from work but can be inclusive of other reasons for time off besides simply vacation.

Learning stipend: a cash benefit employees can access to pursue any kind of professional development or continuing education.

Training and certifications: similar to the learning stipend, a cash benefit to receive a certification that is relevant to the job responsibilities.

Travel perks: opportunities to travel on the company's dime. Some of these perks may also apply to leisure travel, like rental car discount rates.

Employee recognition: recognition of top performers and enhanced visibility. This may be in the form of a public social media recognition or an internal newsletter to incentivize high caliber work.

It’s important to understand these components, as companies choose to emphasize each one to varying levels. Here are some things you should know:

#1

A company’s growth and size directly influences your compensation package

Market rates for the same individual - and even the same kind of work! - can vary depending on what sort of organization you work at. Early stage companies tend to give more equity, while later stage or more mature organizations can provide a stronger base salary. Mature organizations, however, traditionally have rigid compensation levels or brackets which their employees fall into.

#2

Not all compensation is liquid, or available to be spent today.

It seems logical but your base salary gives you physical money you can spend once it hits your bank account. Unlike equity that can take more time to materialize or grow, your base salary gives you “cash” immediately which you can decide to save, spend, or invest. Base salary is also important if your bonus is percent based, but we’ll come back to that in later posts.